Ang pinaka-scary ay yung pag-deposit na kailangan mong gawin sa isang reserved pero hindi pa active na account number, minimum PHP500. Hindi mo kasi alam kung makakadating ba yung pera mo. Kung walang pandemic, safe yung gagawin: go to a Pag-IBIG branch. Tao ang kausap, at doon mismo, kaya niyang i-verify yung account number na dala mo, at sa mismong Pag-IBIG ka magbibitaw ng pera: there's no way your money will get "lost." However, with the pandemic: branches are often closed when ECQ's are announced or when a particular branch has to contain an outbreak. Of course, there's also: let's just stay in, people. So ginawa ko siya, I went through the online enrollment process and deposited money through GCcash, and all is well. Here is how to do it in these steps: 1) Requirements 2) Enrollment/ Reservation of Account Number and 3) Deposit/ Activation of Account.

The Usual Warnings: As with anything on Internet, you take it with a grain of salt, assess your own risks, and make your own decisions. Websites, even official government ones, can get outdated, and even an experience like mine might no longer be the case (as of this writing however, it is).

1. REQUIREMENTS

1. a Pag-ibig account number with 24 months of deposits. Sorry guys, hindi ko ma-verify kung kaya na mas kaunti sa 24 na hulog, pero isa itong explicit na instruction sa website and most of Pag-IBIG's socials.

2. a Virtual Pag-IBIG Account. The following steps are likely to still work even if you don't have the website account, but there's just no online way to check you account without this. This is for peace-of-mind. I will create another post on creating a Virtual Pag-IBIG Account.

2. ENROLLMENT/RESERVATION of ACCOUNT NUMBER

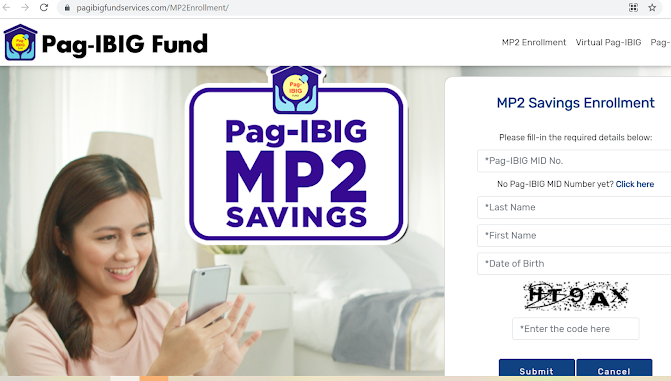

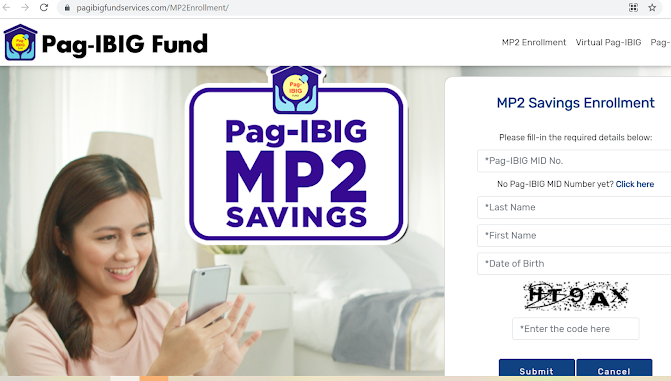

1. Go to the official Pag-IBIG MP2 Enrollment link. This is a working link, but in case you get to it through a search engine, make sure the padlock icon is in the address bar (this tells users their connection is secure), and the usual no misspellings in the URL. It should look like below:

This step is why you have to have your requirements before anything. Off the bat, the website asks you for your Pag-IBIG MID number. To clarify, at the end of this process you will have 2 accounts, your original Pag-IBIG MID number, and a new Pag-IBIG MP2 number. This is helpful because while a lot of payment portals have separate menu options for Regular Savings and MP2 Savings, it's still good to be mindful to which account you are about to deposit. It will also ask you for 1) your last and first names, 2) your date of birth, and 3) the common are-you-human verification. Ang importante dito ay na yung names and date of birth mo ay aligned sa records ng Pag-IBIG. For us Pinoys this can be tricky if our different documents are misaligned, especially when some of those were from years and years back. For such issues, there's really no way around having to fix this first, or inputting wrong details as long as it's aligned with your Pag-IBIG details. The latter is not recommended.

2. The page after will list the details Pag-IBIG has on you. Gustung-gusto ko yung mga pages na ganito, kasi they give us users peace of mind, especially when the details are aligned. In my experience, there were some outdated details, my employer was not yet updated, but in terms of the enrollment process, if you are not going to do an auto-salary deduction into MP2, these can be fixed later.

The important button here is the CONTINUE button on the right side of the page, which we need to click for the next step.

3. This is the Enrollment Form. It is auto-filled based on the details in the previous step, so if your plan to fund MP2 by auto-salary deduction (MODE OF PAYMENT: SALARY DEDUCTION), COMPANY/ EMPLOYER NAME and COMPANY/ EMPLOYER ADDRESS should be correct.

Some notes on the fields.

- DESIRED MONTHLY CONTRIBUTION is non-committal except when MODE OF PAYMENT is SALARY DEDUCTION. In this case, following through the process will have your company's payroll automatically deduct the amount you input here.

- PREFERRED DIVIDEND PAYOUT has the following implications that you can read about in the Pag-IBIG MP2 FAQ's. The biggest implication is when you can withdraw your dividends. This means that the ANNUALLY option is for those who need to be a bit more liquid since you get your dividends every year. One advantage of the FIVE-YEAR (END TERM) option is the compounding (dividends earn dividends also) that you can enjoy automatically. The same FAQ link has a very clear yearly table for both options. To emphasize, you'll only be able to get your PRINCIPAL at the end of the 5 years in both cases; it's what happens to the DIVIDENDS that's different between the two.

4. The result is a for-printing form that looks like this:

- The most important piece of information here is the MP2 Account Number (in green). This is reserved but not yet active until at least PHP 500 is deposited into that account number. And this is the leap of faith step I talked about. In my mind, there were fears that my money is taken, but the MP2 Account Number remains inactive, or is suddenly under another person.

- There is also a portion for signatures, in particular one where we authorize our employer to deduct.

There are instruction to submit this to one of the Pag-IBIG Branches, but in my experience, this is only important in the MODE OF PAYMENT: SALARY DEDUCTION scenario. Pag-IBIG and your company's payroll need signed authorization from you to do so, and this is where submitting the physical form is critical. Ulitin ko lang po, importante na ipasa ang physical na form, kasama ang pirma kung SALARY DEDUCTION ang pipiliin. Otherwise, in my experience, you can just go to the next (and last) set of steps.

3. DEPOSIT/ ACTIVATION of ACCOUNT

1. Below are the navigation steps to pay through GCash.

The only thing that needs emphasis here are that Type should be Modified Pag-IBIG II Savings, and that of course, you put in the correct MP2 account number (again, iba po ito sa MID).

There are usually questions about period coverage, we'll discuss how deposits look on the Virtual Pag-IBIG website later, but essentially, Pag-IBIG renders deposits per month. In my initial deposit, I unwittingly gave a coverage that spanned 2 months, so the deposit amount was split in 2, and recognized under 2 months.

For some reason, because GCash does not verify the correctness of your MP2 Account Number, you can do the initial deposit through here. On the Virtual Pag-IBIG website, there's a verification step, which reserved account numbers do not pass.

You get the usual GCash confirmations of the GCash Payment through email and text, but honestly, without the Pag-IBIG confirmation, this was the uneasy part of the process for me.

2. Check your MP2 Account through Virtual Pag-IBIG. My deposit was credited 2 days after my GCash transaction.

The helpful thing about the website is that you can drilldown to see contributions per transaction. It's the transparency that I wish were easier to access in other government transactions, so kudos to Pag-IBIG.

3.

Make your deposits. I have tried deposits through GCash, BPI, and Virtual Pag-IBIG. It's not real-time, but the 2 days posting is good enough for me. My preference however is Virtual Pag-IBIG because of this step:

If you put in a wrong account number, it will get flagged and is not accepted, and when you do put in the correct one, parts of the form are auto-filled. It's just good verification.

And that's, I've confirmed an all-online MP2 Opening and Deposit!